Getty Images

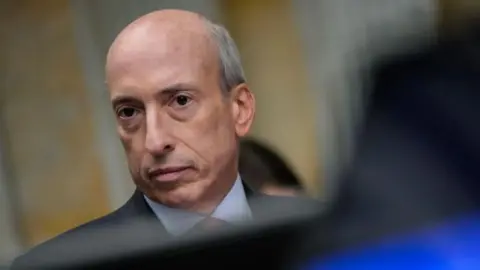

Getty ImagesThe cryptocurrency industry is “rife with fraud and hucksters and grifters”, one of the United States’ top financial regulators has told the BBC.

The chair of the US Securities and Exchange Commission (SEC), Gary Gensler, says the “investing public around the globe has lost too much money” because of crypto companies not following the laws his agency tries to enforce.

It comes as the industry is spending millions of dollars on political donations, trying to influence the outcome of November’s US elections in the hope of more favourable future laws.

In addition to the presidential battle between Donald Trump and Kamala Harris, all 435 districts in the House of Representatives are up for re-election, as well as 33 of the 100 seats in the Senate.

The future of cryptocurrency, one of the world’s most hotly-debated technologies, is an issue where there appears to be a clear dividing line between Donald Trump and the outgoing Biden administration.

Trump has been courting the votes of crypto enthusiasts by promising to make America “the crypto capital of the planet”, and creating a “strategic national bitcoin stockpile” similar to the US government’s gold reserves.

Last week he launched a new crypto business called World Liberty Financial, and although he provided few details, he said “I think crypto is one of those things we have to do”.

It’s a huge turnaround from three years ago, when he dismissed Bitcoin as something that “seems like a scam” and a threat to the US dollar.

Trump’s new-found enthusiasm is a stark contrast to the Biden administration, of which Harris is the vice president. The White House has led a sweeping crackdown on crypto firms in recent years.

In March, Sam Bankman-Fried, the founder and boss of FTX was jailed for 25 years for fraud, after he stole billions of dollars from customers around the world, many of whom are still trying to recover their money.

Then in April, the founder of the world’s biggest crypto exchange, Binance’s Changpeng Zhao, got four months in prison, and the company paid a $4.3bn (£3.2bn) fine. He admitted to allowing criminals, child abusers and terrorists to launder money on his platform, in a case brought by the US Justice Department.

The SEC also has a case against Binance going through the courts. It is one of a record-high 46 enforcement actions the financial regulator took last year against firms trying to profit from what is still an emerging technology.

Getty Images

Getty Images“This is a field that has come along, and just because they’re recording their crypto assets on a new accounting ledger, they [wrongly] say ‘we don’t think we want to comply with the time-tested laws’,” says Mr Gensler.

He explains that rules that force companies that want to raise money from the public to “share certain information” with them have been in place to protect investors since the SEC was created.

This was back in 1934, in the aftermath of the infamous Wall Street crash of 1929 that heralded the Great Depression.

“Crypto is just a small piece of the US and worldwide capital markets, but it can undermine trust that everyday investors have in the capital markets,” says Mr Gensler.

Whilst fans argue that crypto offers a fast, cheap and secure way to move funds, a survey by the US central bank, the Federal Reserve, found that the number of Americans using it has dropped from 12% in 2021 to 7% last year.

Harris hasn’t said much about cryptocurrencies, but one of her advisors did say last month that she would “support policies that ensure that emerging technologies, and that sort of industry, can continue to grow”.

Recent meetings between her team and industry executives have been trying to build trust, and given crypto bosses hope of a brighter future whoever wins in November.

“I can’t underscore enough how important this is, not just for the US, but for the for the world,” according to Paul Grewal, who is chief legal officer at crypto firm Coinbase. He has been at these meetings.

“Not only is the US an important market for crypto, but so much of the important technology surrounding has been developed here. And I think it’s also critically important that we not lose sight of the fact that the rest of the world is not simply waiting for the US to get its act together.”

He adds that given how tight the race for the White House is, “every vote is going to count, and crypto votes are no exception”.

Getty Images

Getty ImagesThe clampdown on cryptocurrencies in the US this year has been mirrored in Europe. In April, the European Union agreed new laws to try to reduce the risk of crypto being used by criminals.

However, other regulators are being slower to act. The G20 group of leading economies is working on minimum standards for cryptocurrencies, but they are not legally binding, and uptake has been slow.

Back in the US, a bill to regulate cryptocurrencies has been passed by the House, but not the Senate. Its critics argue it will give less protection to consumers.

Coinbase’s Mr Grewal backs the bill, and says: “This is not an industry that is shying away from regulation.” He adds that the sector just wants the same standards applied to crypto as are applied to other assets, “no tougher, but no weaker”.

With November’s US elections on the horizon, the crypto industry has sensed an opportunity to help elect lawmakers who take a sympathetic view of the businesses.

By last month, the sector had already spent an unprecedented $119m on donations, according to research by the non-profit Public Citizen.

The consumer advocacy organisation’s research director Rick Claypool says the money is being used “to help elect pro-crypto candidates and attack crypto critics, this is regardless of political affiliation”.

They’ve spent more than any other industry when it comes to corporate donations, because they “are attempting to discipline the US congress to give in to their demands for less oversight, and to weaken protections for consumers,” he adds.