Thomas Cook India Group has announced strong financial results for the first quarter of FY25, registering a Profit Before Tax (PBT) of INR 1073 million, a 17 per cent increase compared to INR 914 million in Q1 FY24. The group’s consolidated gross and EBITDA margins have been sustained, reflecting a stable performance amidst various challenges.

In the recently announced robust financial results for the first quarter of the fiscal year 2025, the company reported a consolidated profit before tax (PBT) of INR 1,073 million, marking a 17 per cent increase compared to the same period last year. On a standalone basis, Thomas Cook saw its PBT grow by 29 per cent year-on-year, reaching INR 740 million in Q1 FY25, up from INR 574 million in the prior year. This significant growth emphasizes the company’s strong financial health and effective management.

Breaking down the numbers further, Thomas Cook’s overseas destination management companies showed a remarkable turnaround. They posted an EBITDA of INR 28 million, a significant improvement over the INR 44 million loss recorded in Q1 FY24. This positive shift highlights the company’s enhanced operational efficiency and strategic initiatives in international markets.

Further solidifying its financial standing, the company added INR 3.49 billion to its reserves during the quarter. As of June 30, 2024, Thomas Cook’s cash and bank balances totaled an impressive INR 18.67 billion. This substantial liquidity underscores the company’s financial resilience and ability to invest in future growth opportunities.

To add to the positive momentum, CRISIL, a credit rating agency, upgraded Thomas Cook India‘s Rating Outlook to ‘Positive.’ They reaffirmed the company’s ratings at CRISIL AA-/Positive and CRISIL A1+. This upgrade reflects market confidence in the company’s financial stability and future prospects.

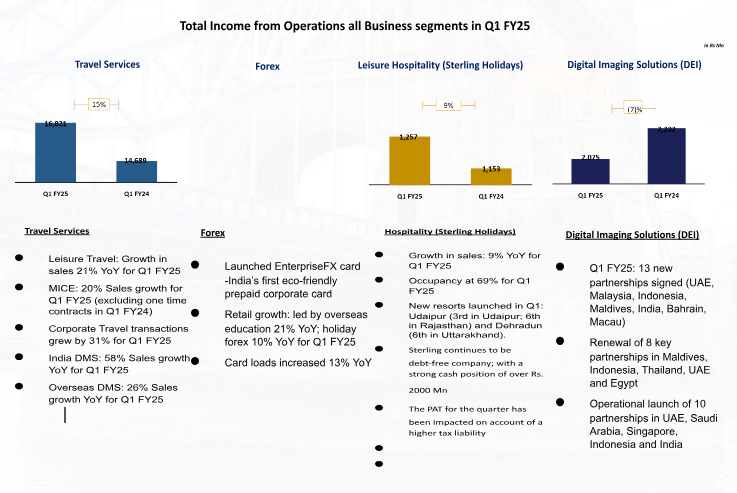

Business segment performance:

The business units within Thomas Cook India Group reported significant milestones, enhancing services with innovative digital tools and expanding their reach. In the latest quarter, they launched digital initiatives like Video KYC for forex bookings and Forex services via WhatsApp. They also opened seven new retail outlets, showing a clear focus on growth and customer convenience.

The hospitality segment, Sterling Holidays, recorded their highest-ever Q1 revenues at INR 1,257 million. Their resorts not only maintained a network of 50 locations but also enjoyed a 69 per cent occupancy rate. Financially, they remained robust, holding more than INR 2,000 million in cash. Guests gave high marks to these resorts, as reflected in TripAdvisor ratings. EBITDA margins stood strong at 34 per cent, indicating efficient operations.

In Travel Services, the corporate travel section gained new accounts across various sectors. They successfully retained key global clients and saw a notable rise in non-air business. The MICE (Meetings, Incentives, Conferences, and Exhibitions) segment was very active. They managed over 50 groups traveling to both domestic and international destinations. Leisure Travel conducted exclusive charter flights and teamed up with the Uttarakhand Tourism Development Board for unique travel experiences.

Destination Management Services (DMS) in India showed a remarkable 58 per cent year-over-year growth. The international DMS segments in regions like the Middle East, USA, and Asia Pacific also performed well. Growth was particularly strong in countries such as Thailand, Vietnam, Malaysia, and Singapore.

Digital Imaging Solutions (DEI) renewed eight partnerships and signed 13 new ones in various countries. They expanded their operations in places like the UAE, Saudi Arabia, Singapore, and India.

Commenting on the results, Madhavan Menon, Executive Chairman, Thomas Cook (India) Limited, remarked, “Thomas Cook India has delivered a robust performance in Q1 FY25, achieving a consolidated PBT of INR 1073 million. Despite challenges such as the Indian General elections and heatwaves, our diverse business segments have shown resilience and growth. Our forward booking funnel indicates a promising extended holiday season, positioning us well for sustainable growth in the coming quarters.”