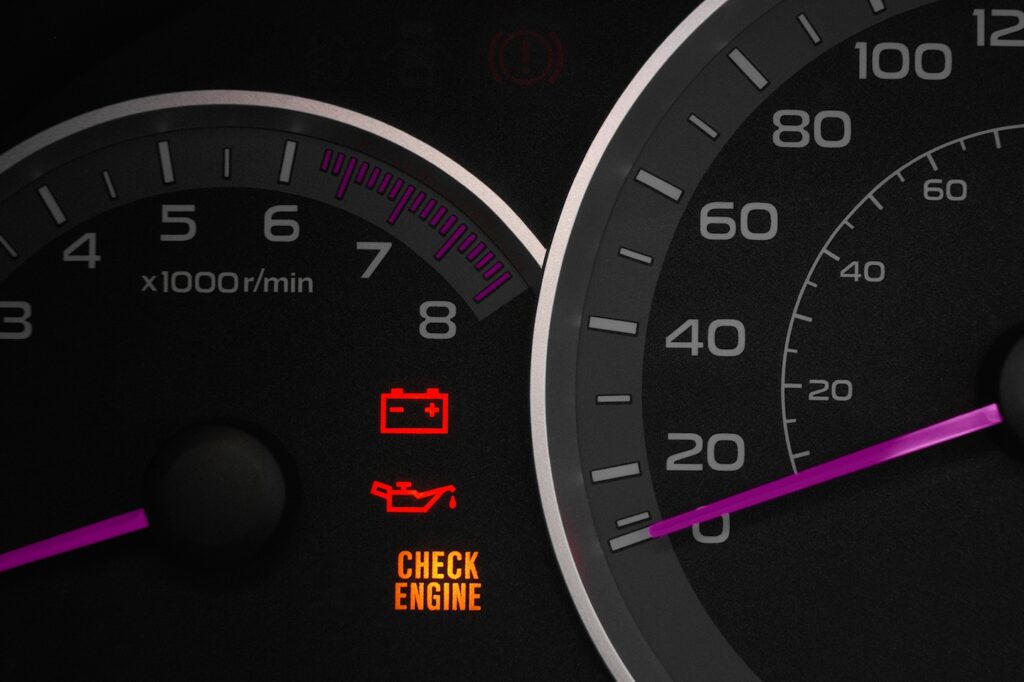

A check engine light flashes and you pull out your owner’s manual hoping it’s a loose gas cap and not something serious, like a faulty catalytic converter. Understanding this anxiety, CarShield, which heavily advertises on television, offers vehicle service contracts promising to be your financial knight should you need to make that dreaded trip to the mechanic.

Vehicle owners are told their monthly premiums would save them from worry.

“Drive with more peace-of-mind, knowing your vehicle and budget are protected from the unexpected,” CarShield advertises.

But like so many of these service contracts, the devil is always buried in the fine print. Too often there are so many exclusions it renders the policy useless.

So it was no surprise to me when the Federal Trade Commission announced this week an eight-figure settlement with CarShield. It wasn’t a car owner’s savior, the agency said.

“Instead of delivering the ‘peace of mind’ promised by its advertisements, CarShield left many consumers with a financial headache,” Samuel Levine, director of the FTC’s Bureau of Consumer Protection, said in a statement. “Worse still, CarShield used trusted personalities to deliver its empty promises.”

The FTC said that Missouri-based NRRM, LLC, which does business as CarShield, along with American Auto Shield, LLC, the administrator of its vehicle service contracts, agreed to pay $10 million to settle charges of deceptive and misleading advertisements and telemarketing pitches.

CarShield advertises and sells service contracts ranging from about $80 to $120 a month, the agency said.

“While we disagree with many of the assertions from the FTC, we share their commitment to helping customers fully understand exactly what we provide and the value we offer,” CarShield said in a statement.

If you’re considering signing up for a vehicle service contract, I think it’s helpful to walk though the FTC complaint against CarShield.

Celebrity endorsements

The regulator alleged that CarShield advertisements with celebrity endorsers, including sportscaster Chris Berman and actors Ice-T and Vivica A. Fox, were false or misleading.

Some celebrities were “nominally contract holders,” but never actually used CarShield for vehicle repairs, the agency said.

When other celebrity endorsers use the CarShield plan, the FTC said, they were treated as “preferred customers” and far more likely to have their repair claims approved than a typical consumer.

“We are making very clear that all spokespeople in our ads are actual CarShield customers,” the company said following the settlement.

Exclusion nightmares

The FTC said that only after purchasing a contract and “authorizing” CarShield to sign it on their behalf did consumers receive their contract, a “dense, 25- to 30-page document, filled with numerous exclusions, terms, and conditions that are not disclosed in CarShield’s advertising or by its telemarketers.”

Despite hundreds or thousands of dollars, consumers were often stuck having to pay for the very repairs they were assured would be covered, the FTC said in its complaint.

Although the agency documented a 2012 consent judgment and permanent injunction with the state of Missouri for misleading consumers, CarShield general counsel Michael E. Carter blamed the pandemic and supply-chain issues for problems with finding a mechanic to get their vehicles repaired.

“Though we welcomed the FTC’s insights, it was unfortunate the FTC brought its gaze on our industry during the most tumultuous business climate in United States history,” Carter said in an emailed statement.

The company said its marketing efforts will now include additional details about car repairs typically covered and direct potential customers to their website for information about the plans they offer.

“Companies may try to rush you through contracts, but it’s always important to read them before agreeing,” Levine said in an email. “Look for exclusions that deny coverage or restrict where you can get your car serviced.”

Can’t use auto shop of their choice

According to some consumers, their preferred mechanic or dealership was unwilling to take on their repair job because of prior bad experiences with CarShield.

“Everyone laughs when I ask if they accept CarShield as coverage,” according to one customer cited in the FTC complaint.

Another said, “Out of the 10 repair facilities I called from CarShield’s website, all said they did not accept CarShield.”

To cover a claim, repair facilities had to “comply with burdensome claims requirements” that included submitting maintenance records, photographs, and allowing third-party inspectors into their garages to check the consumer’s vehicle.

Before paying for a vehicle service contract, call around yourself to local auto repair shops to find out their experience with handling claims from the company.

Don’t let your fear of future repairs scare you into a policy that won’t do you much good.

High out-of-pocket costs

Even for “approved” repairs, consumers found CarShield wouldn’t completely cover labor costs. Facilities are reimbursed in an amount the company approves based on unspecified “nationally recognized labor guides,” the FTC said.

“Consumers are financially responsible for the cost difference between this amount and what the repair facility charges,” the agency said. “Thus, consumers are often left with substantial out-of-pocket costs.”

Poor car rental coverage

The FTC said rental car coverage was approved only after CarShield has authorized a repair claim, which often takes days or weeks after a claim is submitted.

“Consumers with denied claims receive no rental car, while many consumers with ‘approved’ claims must pay a portion of their rental car costs,” according to the agency’s complaint.

In response to the settlement, the company said it has expanded rental car coverage and provided ride-share benefits.

As for the settlement, consumers do not need to take any action at this time, the FTC said. A refund process will be announced in the coming months.

Looking at the complaint against CarShield, you might find that putting money aside in a dedicated saving account for auto repairs is a better financial move, Levine said.