By Faisal Islam and Lora Jones, Economics editor & Business reporter, BBC News

Getty Images

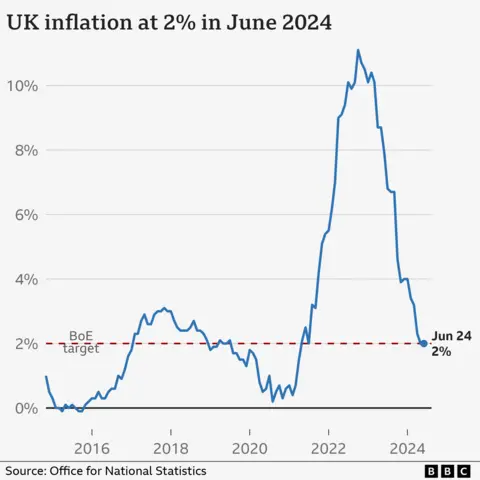

Getty ImagesUK inflation held steady in June, remaining at the Bank of England’s target rate of 2%, according to the latest official figures.

Discounts on clothes in summer sales helped offset the soaring cost of hotel stays.

Overall, inflation rose at 2% in the year to June, unchanged from May.

It means that the cost of living is still rising but at a rate that the central bank is comfortable with, after nearly three years of above-target inflation which has squeezed household finances.

The latest figures showed clothing and footwear costs fell last month, while food and drink inflation has dropped sharply from the highs of recent years.

Grant Fitzner, chief economist at the Office for National Statistics (ONS), told the BBC’s Today programme that there was a “higher level of discounting”.

The figures also showed that second-hand car costs fell but by less than the same time last year.

Prices in restaurants and hotels rose more than a year ago though, putting some upward pressure on the headline inflation rate.

Hotel prices jumped by 8.8% compared with the previous month, the ONS said, whereas prices in restaurants and cafes went up by 0.3% on a monthly basis.

The figures also showed the costs of package holidays, cinemas, theatres and concerts were rising.

However, in areas like services, which include everything from restaurants to hairdressers, price increases remain persistent.

That could raise questions for Bank of England policymakers over when they should begin to cut interest rates.

Darren Jones, the new chief secretary to the Treasury, said that families’ budgets across Britain were still being squeezed.

“We face the legacy of 14 years of chaos and economic irresponsibility. That is why this government is taking the tough decisions now to fix the foundations so we can rebuild Britain and make every part of Britain better off.”

The Bank’s base rate – which is used to help set mortgage rates and other borrowing costs – currently stands at a 16-year-high of 5.25% after it was increased in a bid to tackle soaring inflation.

Its Monetary Policy Committee (MPC), which votes to set the rate, has held interest rates at this level for several months but some economists have predicted they will cut the rate at the next vote on 1 August.

Leanne Morgan and her husband Gareth bought their house in Greenwich, south-east London, in 2016 when interest rates were much lower.

Their five-year fixed mortgage deal came to an end this month and their new rate stands at just over 4% – pushing their mortgage payments up by £5,200 a year.

Mrs Morgan said the higher mortgage payments had restricted the things they were able to do with their three older children.

“We can’t have family holidays, we’ve not been able to do so much with the children… it affects where I shop for food, I’m always looking for discounts. We sit together, we look at what our costs are, where we can cut back and look at a budget.”

She said she was optimistic, however, that the UK economy was over the worst and that better times were ahead.

“I think sometimes the doom and gloom that we talk about can actually make us feel very negative,” she said.

“But if we have a good conversation about what is possible, and working with what we’ve got, we can have a better conversation about it.”

The overall inflation rate has fallen sharply since October 2022, when it peaked at 11.1%.

But some of the underlying measures of inflation being watched closely by the Bank of England remain stubbornly high.

Inflation in the services sector, for example, remained at 5.7% in June, while core inflation, which strips out the effects of more volatile items like energy prices, held at 3.5%.

Finely balanced decision

Alongside some other stronger figures for the economy in recent days, it may give some pause for thought for members of the Bank of England committee deciding interest rates next month.

On Tuesday, the International Monetary Fund listed the UK among countries who might need to keep interest rates “higher for even longer” than originally anticipated to squeeze inflation out of the system.

Markets have been anticipating that rate cuts will start on 1 August, helping fixed mortgage rates fall.

The latest numbers suggest it will be a finely balanced decision.

On Wednesday investors pared back bets on a rate cut taking place, saying there was about a 35% chance – down from just under 50% before the data was published.

Separately, fresh official figures on the housing market helped give an insight into the costs facing both buyers and renters.

They show the rate at which UK rents are rising is close to a record high, hitting 8.6% in the 12 months to June.

The pace of the increase slowed very slightly on the previous month but remains well above the norm of the last 15 years or so.

House prices also rose by 2.2% in the year to May, the ONS said, with the average price of a home in England now above £300,000.